Challenges or Chances: a Changing Market Landscape for Actuary versus Data Science

By Yiru (Eve) Sun, Roger Yuan, and Mark Spong

Yiru (Eve) Sun, FSA, MAAA, PhD, is a Managing Director at Aon. Roger Yuan is an Analyst at Oliver Wyman. Mark Spong, FSA, MAAA, is a Senior Manager at Oliver Wyman.

Challenges in the Actuarial Recruiting Market

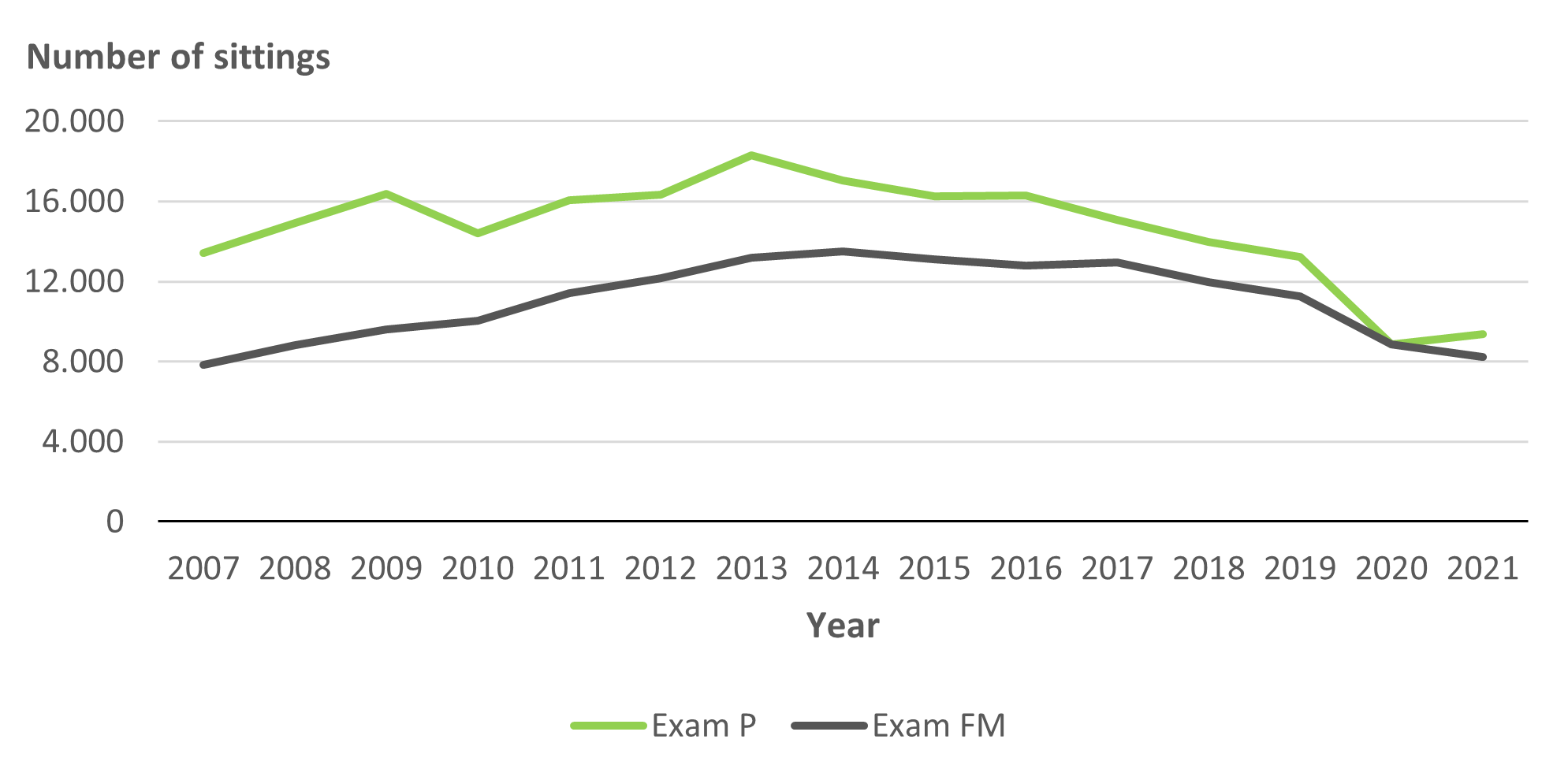

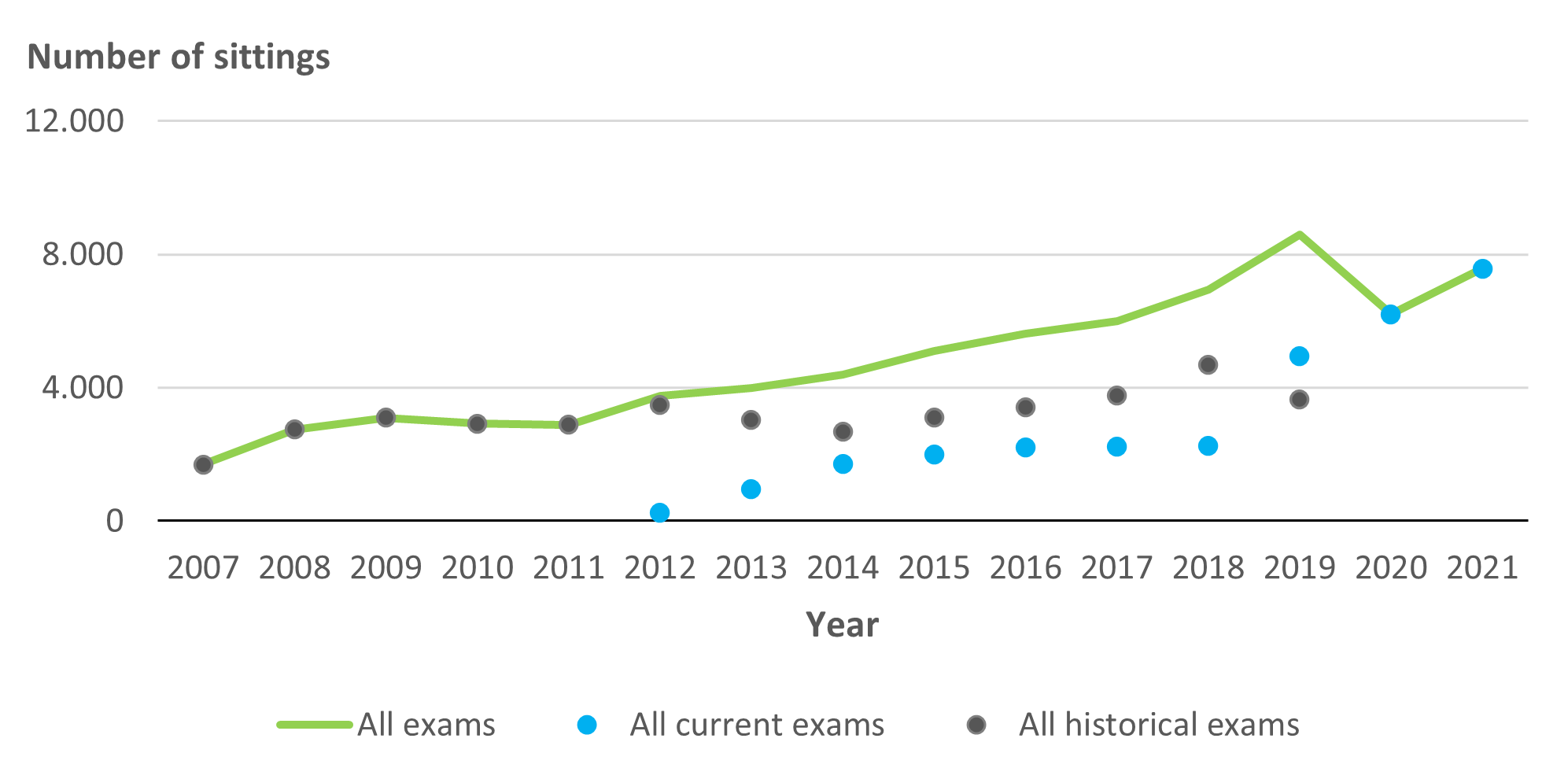

The number of candidates sitting for U.S. Society of Actuaries (SOA) first two exams Probability (P) and Financial Mathematics (FM) decreased almost 50% over the past eight years (Fig. 1), , with an average decline of 7% per year, although the number of candidates had increased steadily before 2013.

Figure 1. Number of sittings for SOA entry level actuarial exams

This trend is consistent with the public perception of the actuarial profession which had been consistently ranked top 3 in national job lists for multiple years before 2013, then the rank quickly dropped to 10 or beyond since mid-2010s, which coincides with the timing when the need for data science emerged. Table 1 compares the ranking of actuary, software engineer, and data scientist, out of top 200 jobs from CareerCast over the past decade. Other sources showed similar trend, i.e., actuary was ranked #1 by CNN and Wall Streat Journal around 2010, while currently U.S. News ranked actuary #20, behind software developer (#5) and data scientist (#6).

Table 1. Trend of job rankings of actuary, software engineer, and data scientist from CareerCast 4

There is no 2020 job ranking on careercast.com.

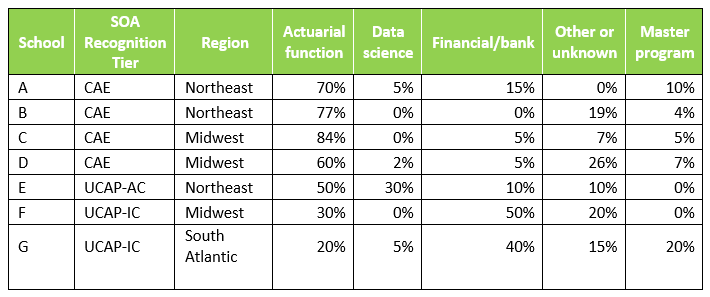

One hypothesis is that data scientists and similar job openings are drawing potential actuaries away from the profession. We queried fifteen colleges, actuarial clubs, and their recent graduates to see if this trend was noticeable. Table 2 illustrates the distribution percentages of actuarial graduates moving to various career paths that we collected through interviews or other communication channels. Several other schools that could not share the distribution percentages with us also provided their qualitative observations. Some key learnings summarized below:

- Candidates at schools with SOA’s Centers of Actuarial Excellence (CAE) recognition are more than twice as likely to remain on the actuarial career path, than schools that SOA recognized as Universities and Colleges with Actuarial Programs - Advanced Curriculum (UCAP-AC) or Universities and Colleges with Actuarial Programs - Introductory Curriculum (UCAP-IC). Further, the strongest programs appear to attract other majors due to the top-tier program and resources

- Recently established data science majors are pulling some students away from actuarial science. Although the percentage of such change has been low so far, quite a few interviewees perceived that the popularity of the actuarial science program is declining

- For international students in U.S., there is a general perception that it is harder to get an actuarial job that provides working visa sponsorship, while most data science jobs still provide sponsorship

Table 2. Distribution of actuarial students to various career paths in recent years

Sources: Data were obtained from interviews with schools’ actuarial clubs, or professors, or recent graduates.

The mixed results between the first two findings suggest that the strongest college actuarial programs are becoming stronger while schools with fledgling or small programs may be struggling. For example, actuarial career fairs tend to be successful only after achieving a level of scale so that they are well attended by both prospective hires and recruiters.

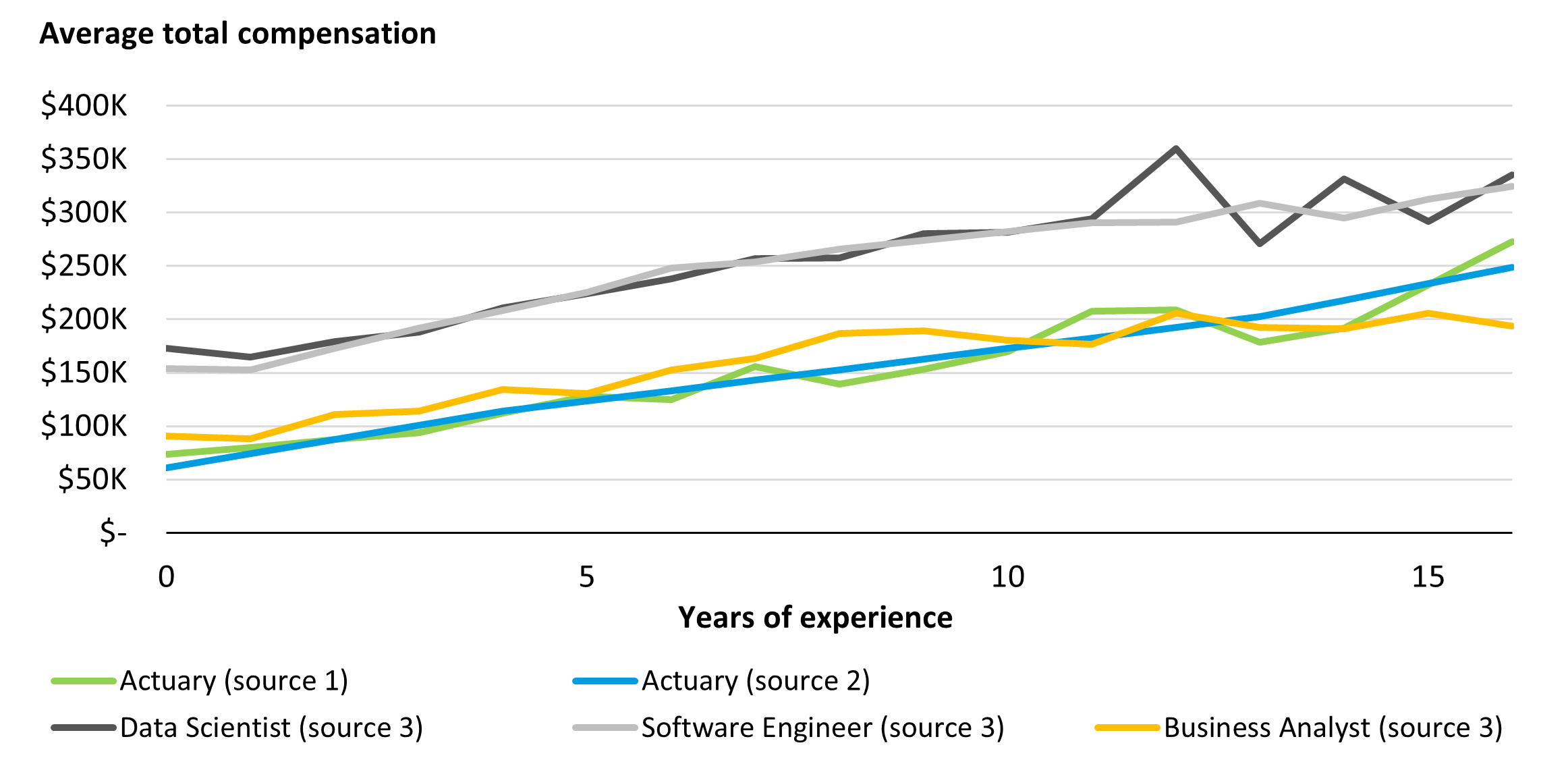

In addition to qualitative interviews and historical sitting numbers, we also investigated average compensation and location. These two factors can be benchmarked explicitly and can provide some insight into the perceived attractiveness and ease of entry of the two career paths.

We compared the trends of total compensation (base salary plus bonus) among actuaries, data scientists and its related careers in Figure 2. The actuaries’ average incomes are lower at both entry level and experienced management levels.

Figure 2. Comparison of average total compensation by years of experience

Regardless of accuracy or bias in these figures, they are still important to review because they shape public perception and influence candidate decisions.

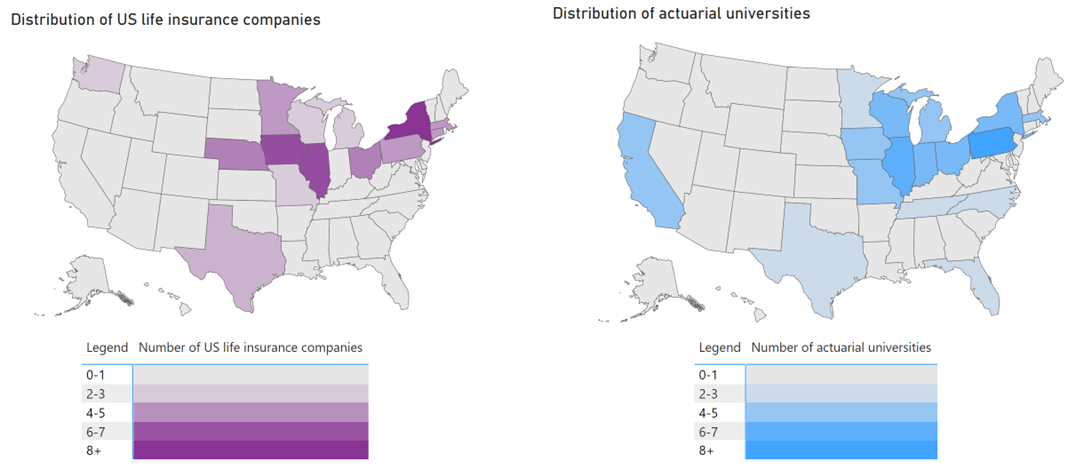

In addition to compensation, location is also one of the fundamental factors that influence candidate decisions. Figure 3 plots the distribution of 79 life insurance companies’ headquarters in U.S., and all 77 U.S. universities and colleges that have actuarial programs recognized by SOA as CAE or UCAP-AC. The distribution highly overlaps with each other. Both life insurance companies’ headquarters and actuarial schools concentrate in the Midwest and Northeast states. It is notable that not all actuarial functions located in the same state as the company quarters, however the maps still tell a meaningful story. For states with high population like Texas, California, and Florida, there may be only one to three life insurance companies, while a great many companies hire data scientists and/or software engineers across most states.

Figure 3. Distribution of U.S. life insurance companies and U.S. actuarial universities

These two heatmaps plot the geographic distribution of 79 life insurance companies’ headquarters in U.S., and all 77 universities and colleges that have actuarial programs with SOA recognition of CAE or UCAP-AC in U.S.

The maps highlight another key factor that, for states with fewer actuarial employment opportunities, the lack of a professional network or role models may effectively act as a barrier to build the awareness of actuarial profession among students and professors. This may explain why high percentage of potential candidates never fully explore actuarial opportunities.

On the bright side, although the number of candidates sitting SOA entry-level exams decreased considerably, the total number of sittings for high-level exams aiming toward Fellowship of Society of Actuaries (FSA) continues to increase (Fig. 4). This indicates that the broad horizon of actuarial career still attracts and engages a lot of talented actuarial students to explore the depth of it.

Figure 4. Number of sittings for SOA actuarial fellowship exams (including all 6 tracks)

The numbers here counted in all 23 fellowship exams along SOA 6 tracks towards FSA.

With forward looking talent management, insurance companies can better shape recruiting, retention, and the future of their organization. Recruiters may not perceive a shortage of entry level actuarial candidates (yet), but there are still plenty of opportunities to enhance actuarial programs to tailor to the diverse background and interests of the candidates.

This article appeared first in The European Actuary, No. 32: https://actuary.eu/wp-content/uploads/2022/11/TEA-32-DEC2022.pdf